Conclusion of Capital Structure

As you might already know the conclusion part for a successful assignment should not introduce any new ideas yet at the same time it should make existing ideas even clearer. Capital is a resource that all businesses need to operate.

Writing Tips 4 Describing A Place Step By Step B W Descriptive Writing Teaching Writing Essay Writing Skills

To sum up Modigliani and Miller 1958 explain that the firm value is irrelevant to capital structure of firms in the absence of market imperfections.

. Capital structure is a very important aspect of a balance sheet and companies should always ensure it is balanced as it influences the returns. It is important to acknowledge that most capital structure theories cannot be used by companies in real life since these theories lacks of more reality factors. In conclusion Section 4 will summarize the entire essay and suggest further research direction of capital structure theory.

1 Equity Share Capital It is the most common form of the capital structure wherein the owners contribution is reflected. The analysis will be done on three publicly-held companies including Host Hotels Resorts Entertainment properties trust and Mandarin Oriental Hotel Group. Lastly recommendations for further research are described.

Up to 5 cash back Capital Structure. For most of the firms the decision involves a choice between the long-term debt and the equity. Up to 3 cash back CONCLUSION.

It can also show company acquisitions and capital expenditures that can influence the businesss bottom line. This chapter provides the conclusion of this study. In designing the capital structure for any firm the first major policy decision facing the firm is that of determining the appropriate level of debt.

Methodology used to perform the analysis. Capital is usually held in deposit accounts or it is the physical assets of the company. Accurate analysis of capital structure can help a company by optimizing the cost of capital.

A projects cost of capital is the minimum expected rate of return the project needs to offer investors to attract money. A company can raise capital by issuing stocks or bonds to the market. Many studies report the low performance of state-owned firms comparing with fully private firms Dewenter and Malatesta 2001 Alfaraih Alanezi Almujamed 2012 and Boubakri Guedhami Kwok and Saffar 2016.

Capital structure is an important term to understand especially for those who want to advance. The previous chapters described the fundamental concepts underlying the capitalization of private. In this study we have identified the different variables in companys profitability and capital structure of the company and built a relationship between them.

While learning how to write a conclusion paragraph may sound frightening to most students there are several helpful tips and structure examples that you must learn. It should offer the least cost of financing with maximum returns Solvency -the structure should not lead the company to a point it risks being insolvent. Capital structure relates to how much moneyor capitalis supporting a business financing its assets and funding its operations.

However financial capital the money tied up in the business is not free. Conclusion and implications In document Capital structure corporate cash holding and dividend policy in African countries Page 117-126 This study examined the trends and determinants of corporate cash holding across selected African countries. The government-linked firms are known as inefficient firms and they could perform better if they were under private ownership.

Conclusion Since the ability to access capital directly affects the value of a business owner-managers need to understand the ramifications of this value-capitalization relationship in the private capital markets. 0 Capital structure theories based on agency costs Although Berry and Means 1931 cited in Myers 2001 state an adverse relationship between the separated ownership and corporate control status it commonly admits that. The basic purpose of this research is to study and to define the factors which have effect on insurance companies profitability.

Conclusion Target Capital Structure Target capital structure is a function of expected profitability riskiness of operations vulnerabilities to outside constituencies Steps in the Analysis analyze operating profits determine funds needs evaluate vulnerabilities Analysis Determine Reasonable Worst Case Operating Profit Margin. Features of A Good Capital Structure Profitability -it should ensure most profits are earned. Conclusion To summarize it is essential for finance professionals to know about the capital structure.

Thus behavior finance could provide a new approach to extant theories. Profitability of insurance company depends on capital. To begin with the main findings based on the statistically analyses were summarized conclusions will be made and the research question will be answered.

Too much debt threatens a companys solvency so any debt taken should be manageable. Porras Chapter 824 Accesses Abstract All businesses and investment projects need capital to operate. Join learners like you already enrolled.

2Combine agency costs and asymmetric information problems together in one capital structure theory. There are a lot of theoretical and empirical researches on capital structure but there is no generally accepted theory yet and thus it remains an open line of research. Capital can be raised through debt or equity financing or by holding financial assets.

After that the limitations of this research are described and discussed. Ad Shop thousands of high-quality on-demand online courses. The equity shareholders have the right over the businesss retained.

It is the first amount the owners introduce into the entitys business.

Equity Ratio Definition Interpretations And Conclusions Equity Ratio Financial Ratio Equity

Literacy Mat English Teaching Resources

Pin By Lizajd21 On Paralegal In 2022 Law School Inspiration Law School Prep Law School Life

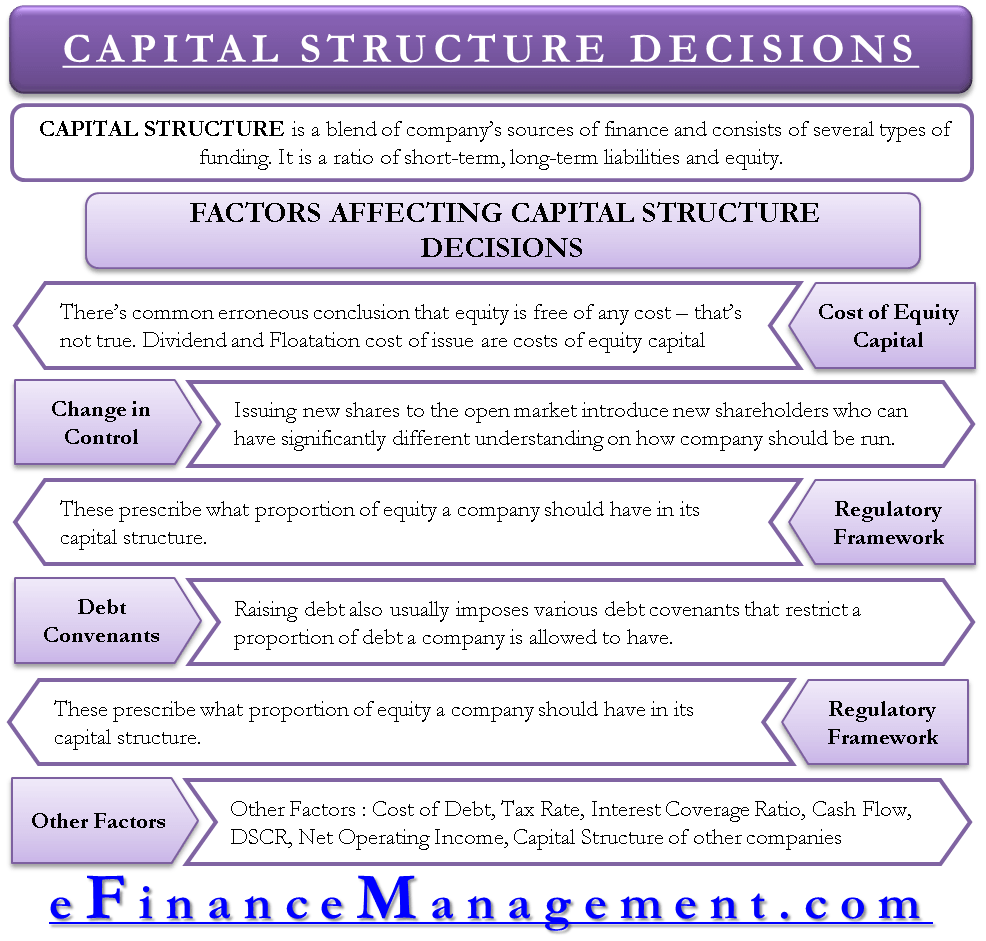

Factors Affecting Capital Structure Decisions Efinancemanagement

0 Response to "Conclusion of Capital Structure"

Post a Comment